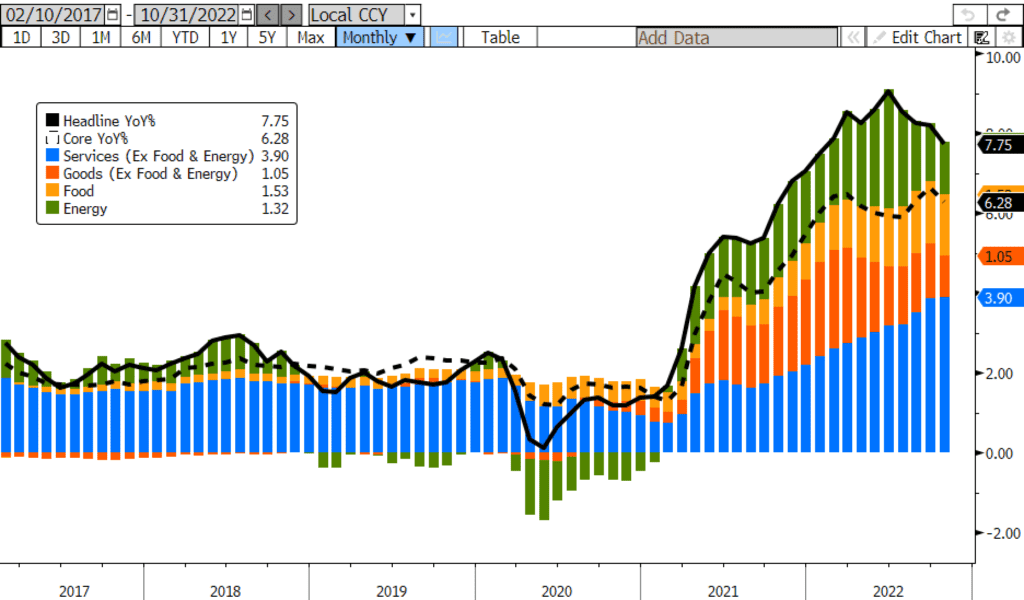

Friendly inflation data and apparent political gridlock have put financial markets in a good mood as this week draws to a close. As the dust settles on Tuesday’s elections, markets seem relatively pleased that neither party will have enough control to do too much damage. Centrists are celebrating. The real story, however, is the latest consumer price inflation numbers which show much needed relief as CPI eased to 7.7% YOY, lower than expected and well below September’s 8.2% pace. It is also the fourth consecutive drop and raises hopes for an acceleration of the downtrend. The core measure rose 6.3%, down from 6.6% in the prior month and also notably lower than estimated. To be sure, one month does not a trend make, and we remain at unacceptably high levels. Still, we are several months down the road from what appears to be the cycle peak of 9.1%. The developing trend looks good.

As post pandemic supply-shortages fade, deflationary pressure is now becoming manifest. Trade flows and transportation of materials have gradually improved after two years of sclerosis. Shippers and distribution networks have successfully developed workarounds that relieve the supply-shock inflation we’ve lived with since early 2020. That’s coupled with 400 basis points of fed tightening since March, which is starting to produce demand destruction that allows firms to hold off on price increases or to adjust their prices lower.

This has all got to be welcome news to policymakers. The markets absolutely love it. Stocks soared to the highest levels since August, and the 10yr Treasury yield collapsed to less than 3.85%, down from over 4.20% three days ago. The 2yr yield which is more closely tied to Fed policy has fallen even further, down 30bps to 4.33% and on pace for a two week low. The dollar finally pulled back on foreign exchange markets too, giving much needed relief to our trading partners.

As for monetary policy going forward, expectations for coming Fed rate hikes have been throttled back. A 50bps hike, rather than 75bps, is now the clear consensus. The futures market now implies a sharply lower terminal rate of 4.86% for next year, falling to 4.40% by the end of 2023. Fed officials acknowledge the good news but with caution. San Francisco president Mary Daly said, “one month of data does not a victory make…” and “pausing is not the discussion, the discussion is stepping down the pace of hikes”.

Next week we’ll get data on producer prices, retail sales, and housing starts among other things. Shout out to all Veterans on this holiday-shortened week.

US Consumer Price Inflation 2017 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

JCaughron@GoBaker.com

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.