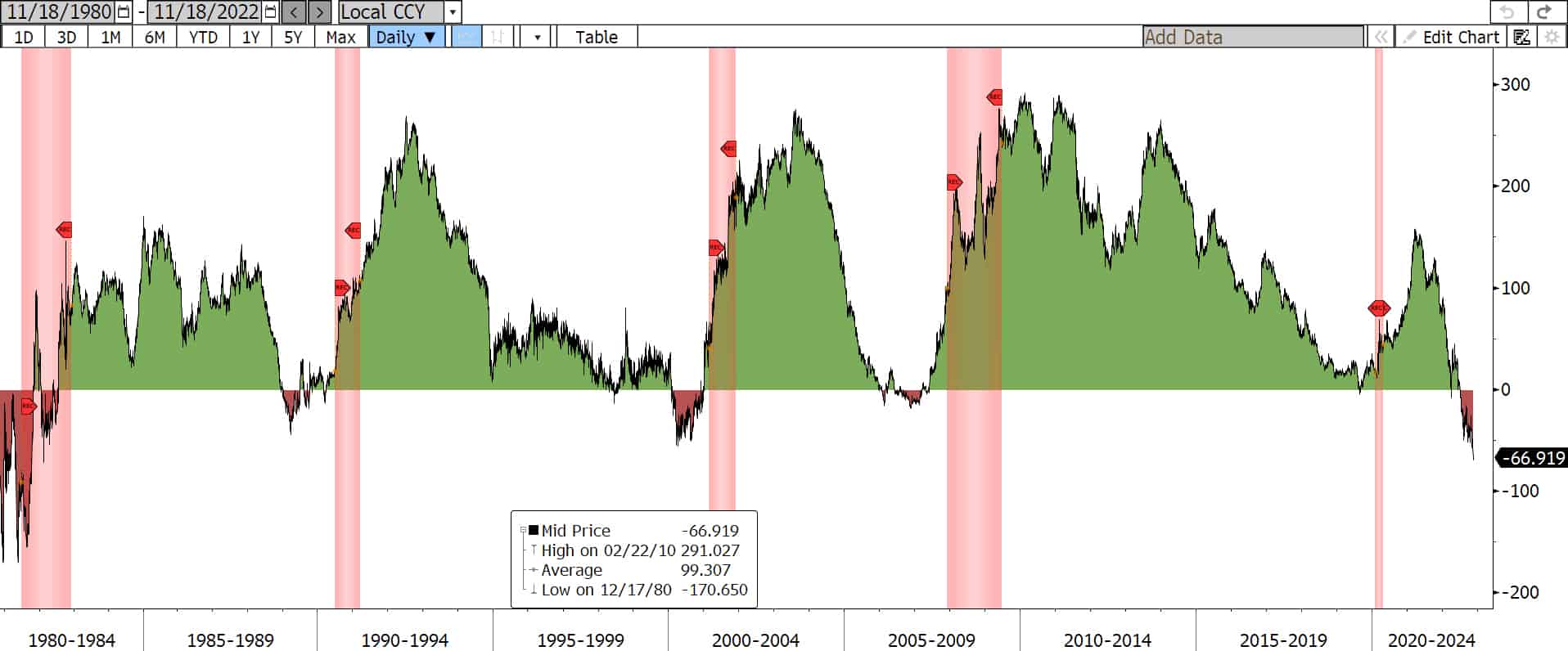

The yield curve further inverted this week with the 2yr yield rising 14bp while the 10yr yield fell 2bp. The 10yr2yr spread has now fallen to -67bp, the most negative it has been since 1981 (see chart below). Federal Reserve officials continue to blanket the speaking circuit with the message that they will do whatever it takes to tackle inflation and that is pushing up short-term yields. On the other hand, longer-term yields are falling as muted inflation reports and weakening economic data support the belief that the economy may enter recession in 2023, which could bring down inflation faster than the Fed forecasts. Fed funds futures are now pricing in a 75% probability of a 50bp rate hike in December, which would be the smallest rate hike since May and could mark the beginning of the end for the most aggressive tightening cycle since 1981.

On the inflation front, producer prices rose a smaller than expected 0.2% in October and 8.0% from a year ago, a sharp drop from the 11.6% increase in March. The benign PPI report combined with last week’s benign CPI report further reinforces the expectation that inflation has peaked and the Fed’s significant rate hikes are having the desired effect. We’ll get one more CPI report the day before the Fed’s next FOMC meeting and that report could very well determine whether the Fed decides to slow their pace of rate hikes.

On the housing front, it was all bad news this week. The National Association of Home Builders Market Index fell for the 11th consecutive month in November to 33 (anything below 50 represents contraction), Housing Starts fell 4.2% in October, Building Permits were down 2.4% and Existing Home Sales fell for a record 9th consecutive month, down 5.9% in October and down 32% since January. The carnage in housing may take a breather in the months ahead as mortgage rates have fallen about 50bp in the last few weeks and that could boost sales in December and January.

On a positive note, Retail Sales for October rose a better than expected 1.3% and the Control Group (excludes certain categories and feeds into GDP) rose 0.7%, suggesting consumers continue to spend money in the face of higher inflation and a weakening economic outlook.

Next week we’ll get reports on Durable Goods Orders, Jobless Claims, Manufacturing PMIs, New Home Sales and the November 2nd FOMC meeting minutes.

10yr2yr Spread Since 1980

Source: Bloomberg Finance L.P.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Ryan W. Hayhurst

President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.