In a holiday-shortened week, we gobbled up some small helpings of economic data but the main show was Wednesday’s release of the minutes for the Fed’s Open Market Committee meeting earlier this month. The essential takeaway was clear… “A substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate.” That sentiment was written into the minutes accompanying the fourth consecutive 75bps rate hike, which now brings the upper band of the Fed Funds target to 4.00%, the highest level since early 2008. Bond prices rallied on the news, stocks held recent higher levels, and the dollar sold off as investors generally welcomed the Fed’s slower trajectory for rates. To be sure, the Fed isn’t finished tightening. They are simply dialing down the magnitude of hikes. The “slowing in pace” was taken by markets to mean we can look for a 50bps bump in December. Fed Governor Waller likened it to piloting a plane after takeoff… “As the policy rate gets higher, the stronger is the case for slowing the rate of ascent while continuing to climb.”

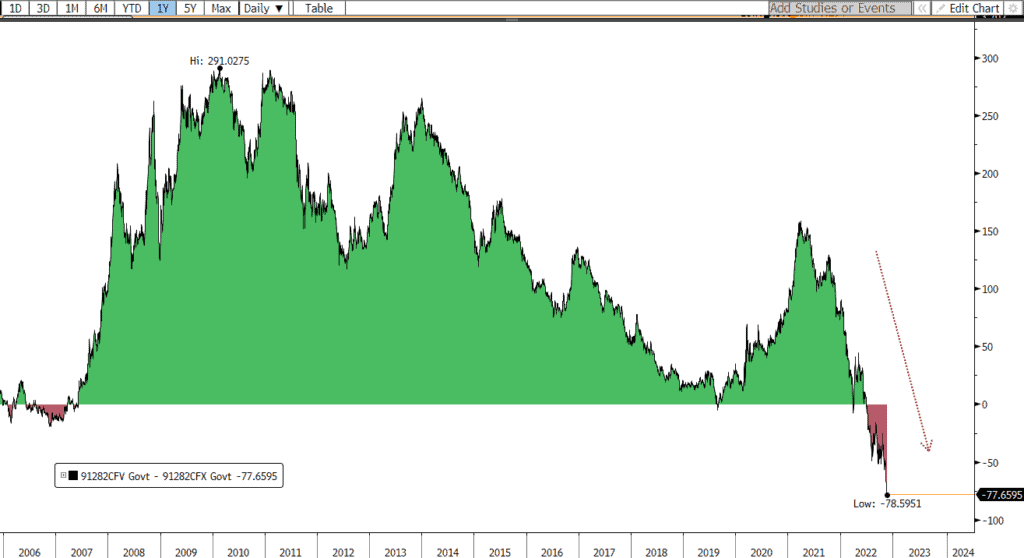

The price action in the bond market is instructive. The 10yr T-Note yield has rallied more than 50bps since it’s October 24th high of 4.24%. Since the FOMC meeting we’ve also gotten friendly readings on consumer price inflation and inflation expectations. Moreover, given the imprecise time-lags of monetary policy, we can reasonably expect that demand destruction from the Fed’s 375bps of tightening to-date will become quite apparent as we move into a new year. Futures markets currently project a 5% peak for fed funds, then a back-bend of 35bps or so by end of ’23. Meanwhile, the yield curve is deeply inverted as the spread between 2s and 10s is -75bps… we’d have to go back to Ronald Reagan’s first term to find the curve more negative… and that was during the reign of Fed inflation-slayer Paul Volker whose playbook the Powell Fed is now using. Perhaps we’re finally about to reach cruising altitude and the seat belt signs will come off.

The data thread this week was light and mixed but meaningful. Durable Goods and Capital Expenditures were stronger than expected (perhaps dollar-related), but jobless claims jumped unexpectedly as the labor market comes off high boil. New home sales showed unexpected improvement, and consumer sentiment was a bit higher per the University of Michigan survey. But readings from S&P’s Purchasing Manger’s Indices (PMI) were not pretty, as both manufacturing and services showed contraction. Next week we’ll have a look at housing prices and the Fed’s preferred inflation measure as well as the employment report for November.

US Treasury Yield Curve: (2yr vs 10yr Yield Spread) 2005 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

JCaughron@GoBaker.com

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.