All news is old news as the market veterans say. And inflation, it seems, is last year’s story if appetite for US Treasuries is any indication. Fed officials are quick to say no, inflation remains too high and their job is not finished by any means. Those who presume otherwise risk gambling on the now-defunct “Fed Put,” something that won’t be used as it has in the past to save us from economic distress. As St. Louis Fed President Bullard says, “the risk is that while inflation is moderating, it does not moderate as quickly as markets are currently expecting.” Time will tell, but for now markets are trading like a tightening endpoint is getting close.

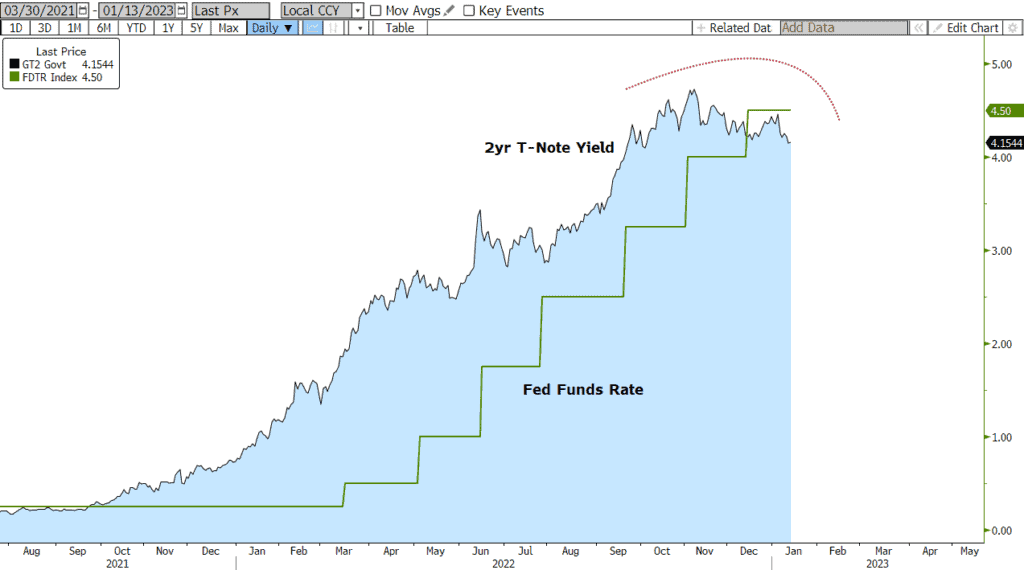

This week’s release of the consumer price index (CPI) and related data showed an unmistakable trend lower as the index clocked a 6.5% reading at year-end, the sixth consecutive decline. It was much lower than the 7.1% in November and more than 2.5% lower than the mid-year high of 9.1%. The “core” level also was lower at 5.7%, down from 6.0% in the prior month. It was good news all around, and much of it was anticipated by bonds which rallied prior to the report and continued to do so through the week. As Friday rolled around, we were seeing a 3.45% yield on the 10yr T-Note, and a 4.17% on the 2yr. Those levels are remarkably lower than last year’s highs which were 4.25% and 4.72% respectively. Moreover, the 2yr yield is now well below the Fed Funds rate which was bumped up to 4.50% in December… an inversion in the shortest segment of the maturity spectrum that warrants a close watch going forward.

From a policy standpoint, improving inflation data suggests officials will strongly consider smaller increases of 25 basis points going forward. They know it takes time to see the full effects of their rate hikes, and they need to avoid causing unnecessary damage to employment and growth. Futures markets are now priced for a terminal rate just shy of 5%... one or two more hikes may do the trick. And then the focus turns to the resilience of the economy as all those rate hikes become fully absorbed. Pay particular attention to the labor market. The year-end jobs report showed a slowing of wage growth, an important input into the broader inflation trend, but payrolls growth remains strong. We’ll see if that “Goldilocks” scenario can continue for the jobs market.

In addition to the CPI report, we got consumer sentiment data this week that showed improved perceptions of current conditions and inflation expectations. Importantly, there were also three very well-received auctions of US Treasuries… $60billion in all… that were easily digested by the market. Next week’s economic calendar is a full smorgasbord of data: retail sales, producer prices, industrial production, building permits, housing starts, existing home sales and leading indicators… all on tap. Stay tuned.

US 2yr T-Note Yield and Fed Funds Rate: 2021 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

JCaughron@GoBaker.com

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.