We entered the first week of the year with a stern reminder from the Federal Reserve by way of their minutes from last month’s FOMC meeting. Those notes contained an unmistakable tone of caution to anyone thinking the Fed might go wobbly in their war on inflation. Policymakers expressed concern that financial conditions had eased a bit too early and that market participants may be misinterpreting the Fed’s expected reaction function to slower growth in the new year. FOMC members saw the need to communicate clearly that slowing the pace of rate hikes (to 50bps rather than 75bps) was in no way a signal of weakening in the commitment to lowering inflation. The consensus thinking on the committee remains that the labor market remains too tight and inflation too persistent.

Speaking of the labor market, the December jobs report showed a still-solid pace of job creation as 223K new payrolls were added for the month, but a notably slowing in the pace of wage inflation… something that the Fed and the bond market are happy to see. Moreover, there are reasons to believe that the labor market will weaken further and wage growth will fade more rapidly as we move through the year. Now at 4.6%, the year-over-year change in average hourly earnings has steadily fallen by a full percent in the last nine months. Average weekly hours worked also flashed the lowest reading since April of 2020, the early days of the pandemic recession. Even with strong payrolls growth, the wage data is trending as the Fed wants it.

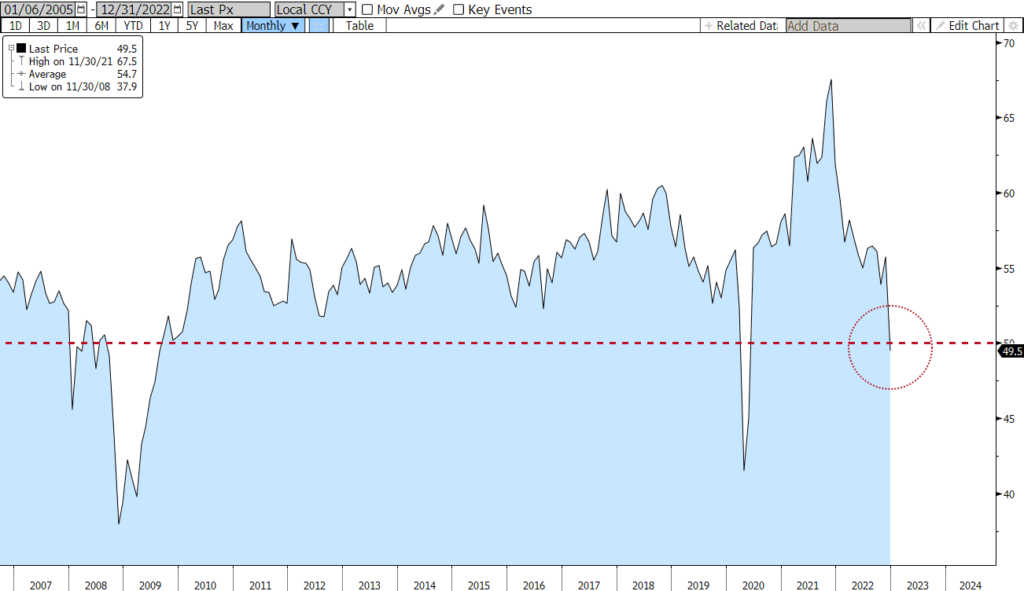

Other important data developments this week involved two key measures from the Institute for Supply Management (ISM). Both manufacturing and non-manufacturing measures fell below the 50% demarcation line which indicates whether those sectors are expanding or contracting. The economywide weighted index is now below 50% for the first time since the 2020 pandemic recession. Trade data for November was also released, showing weakness in both US imports and exports and flashing signs of an impending downshift in global growth.

Next week we can look forward to key data on consumer prices and sentiment as well as $61 billion in Treasury auctions… 3s, 10s, and long-bonds. Plenty for the market to digest both actually and metaphorically.

As for bond market trends, the 10yr T-Note yield ended last week (and last year) right around 3.90%, with the 2yr yield at 4.43%. After considering bond-friendly components the employment report and ISM, those yields had fallen to 3.61% and 4.31% respectively. Futures markets are pricing in a nearly 70% probability the Fed will slow their pace of tightening again at the next FOMC meeting and hike rates just 25bp to 4.5-4.75%.

ISM Economy-Weighted Index – 2005 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.